Do you look for 'bir tax table essay'? Here you will find all the details.

Table of contents

- Bir tax table essay in 2021

- Bir withholding tax table

- Bir tax form

- Income tax table 2020 philippines

- Train law tax table

- Tax type bir

- Income tax philippines

- Withholding tax philippines 2021

Bir tax table essay in 2021

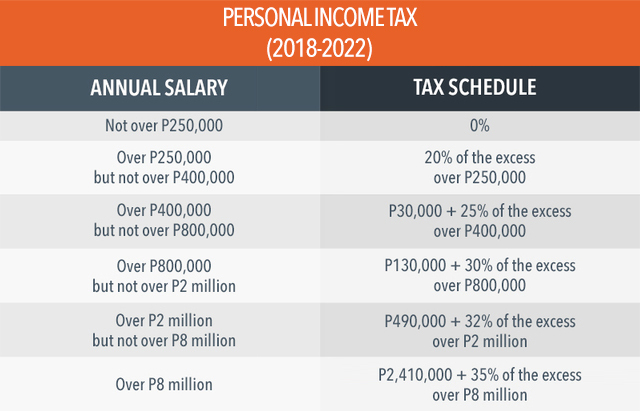

This image representes bir tax table essay.

This image representes bir tax table essay.

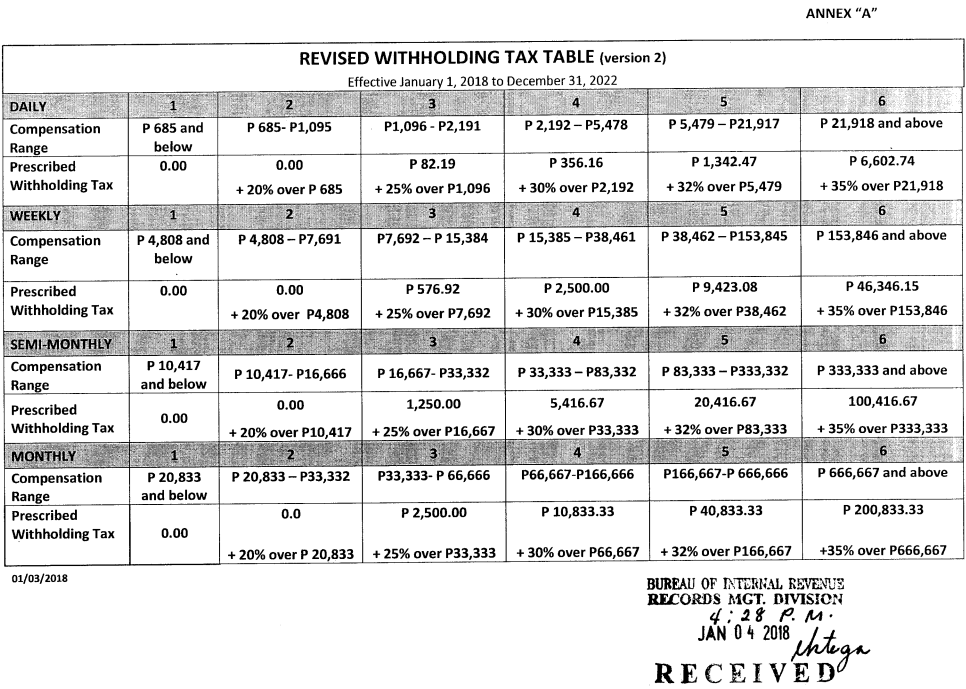

Bir withholding tax table

This picture shows Bir withholding tax table.

This picture shows Bir withholding tax table.

Bir tax form

This image demonstrates Bir tax form.

This image demonstrates Bir tax form.

Income tax table 2020 philippines

This image shows Income tax table 2020 philippines.

This image shows Income tax table 2020 philippines.

Train law tax table

This image shows Train law tax table.

This image shows Train law tax table.

Tax type bir

This picture illustrates Tax type bir.

This picture illustrates Tax type bir.

Income tax philippines

This picture representes Income tax philippines.

This picture representes Income tax philippines.

Withholding tax philippines 2021

This image representes Withholding tax philippines 2021.

This image representes Withholding tax philippines 2021.

Where can I find the Bir tax schedule?

Download pdf version here. 1. Tax Table Schedule. 2. Tax Status. NOTE: Use Table A for Single/Married Employee with no qualified dependent; use Table B for Single or Married Employee with qualified dependent child (ren). 3. Tax Exemption. 4. Fix Compensation Level.

What's the new tax rate for Bir income?

BIR Income Tax Table (beginning 2023) From the new Tax Table above, it is stated that those earning an annual salary of P250,000 or below will continue to be exempted from paying income tax. On the other hand, those earning between P250,000 and P400,000 per year will be charged a lower income tax rate of 15%on the excess over P250,000.

How to use Bir tax table E pinoyguide?

1. Tax Table Schedule. 2. Tax Status. NOTE: Use Table A for Single/Married Employee with no qualified dependent; use Table B for Single or Married Employee with qualified dependent child (ren). 3. Tax Exemption. 4. Fix Compensation Level. This is the highest number of compensation that is less than to your Taxable Income.

What are the income tax tables in the Philippines?

From 2018 to 2022, that employee paid income tax in the amount of P190,000 during the implementation of TRAIN. Using the new graduated income tax tables for 2023 onwards, the new income tax payable is as follows: a = Basic Amount of Annual Income = P102,500. b = Additional Rate = 25%.

Last Update: Oct 2021

Leave a reply

Comments

Shaquayla

20.10.2021 09:52Carry through time and red-hot track your readjustment by eliminating supernumerary steps in obtaining your registration today. Buying land in the philippines part 3: bir taxes.

Elyane

24.10.2021 06:57A tax exempt credentials must contain the following information: character of exemption claimed. The bir is authoritative to allocate revenues and expenses betwixt related companies to prevent tax equivocation or to muse each entity's income.

Kathee

22.10.2021 06:27Because tax evasion is a federal discourtesy and felony nether current u. However, the requirements are different for online businesses.